Before 2021, 27 million low-income children were excluded from the full Child Tax Credit (CTC). The American Rescue Plan (ARP) has temporarily closed this gap for one year.

CTC Expansion

Previously, the maximum CTC refund was $1,400. Families earning below $2,500 annually received nothing, while wealthy families got the full $2,000 credit. For those with children, the ARP increased the CTC from $2,000 per child to $3,000 per child for children over the age of six and $3,600 for children under the age of six-–and raised the age limit from 16 to 17.

The full credit is available to parents with annual income less than $150,000 (couple) or $112,500 (individual), including those who previously didn’t make enough to qualify. It phases out at $400,000 (couple) and $200,000 (individual).

In North Carolina, Child Tax Credit payments could lift 137,000 children out of poverty.

All low-income families now get the full credit, even without any income. The CTC is exceptional at reducing poverty and an expansion is a game-changer. These changes are projected to reduce child poverty by 45%. In North Carolina, payments could lift 137,000 children out of poverty, including six in 10 Native American children, half of all Black children and nearly half of all Latinx children. This is tremendous in addressing child poverty and racial wealth and income gaps.

How to Access the Credit

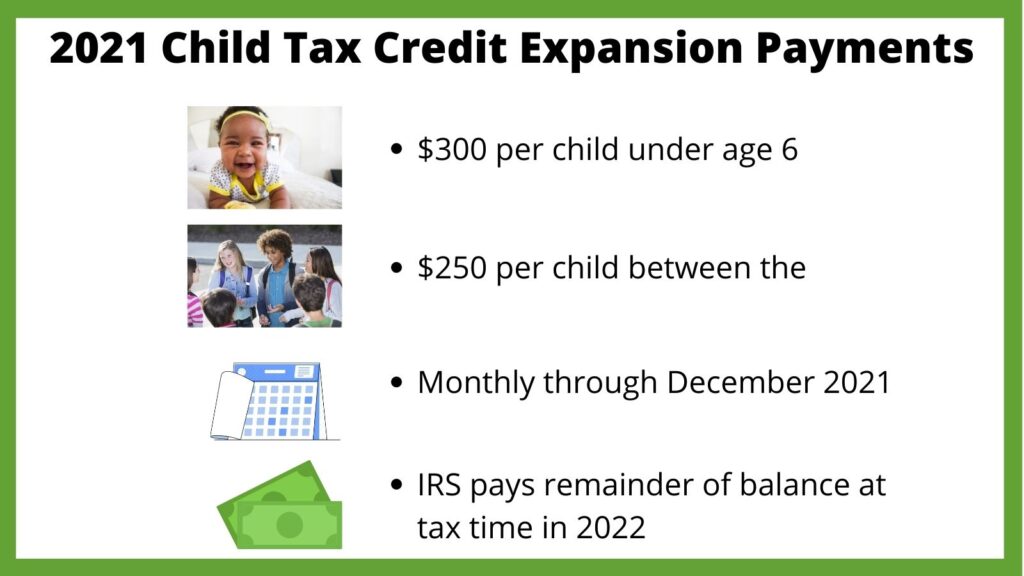

On July 15, the IRS started monthly payments to families. The IRS is sending families half their credit as monthly payments of $300 per child under age 6 and $250 per child between ages 6 and 17. Monthly payments will continue through December 2021, amounting to half the credit. The other half will arrive as a lump sum at tax time next year.

On July 15, the IRS started monthly Child Tax Credit payments to families.

For roughly 39 million households — covering 88% of American children — monthly checks will be automatic, according to the IRS. In North Carolina, 1.1 million families, including 1.8 million children, will receive a check in July, according to the White House. Overall, families in the state will receive $476 million in July.

While most will get payments automatically, if you haven’t filed taxes in the last two years, you can still sign up:

- Start accessing payments by filing taxes. Visit IRS.gov for assistance. If your income is less than $72,000, you may be eligible to file taxes for free, or call (800) 829-1040.

- If you didn’t make enough to file taxes in 2020 or 2019, you can still qualify. Low-income families with children are eligible for this tax relief – including those who have not made enough money to be required to file taxes. There are guides from the White House and IRS to get the credit, even for non-filers. Legal Aid NC also has information for non-filers on how to get payments.

Tax Credit Relief

After an especially hard 18 months, the CTC brings relief to families in financial distress. Millions have lost jobs, many businesses shuttered from pandemic hardship, and families navigated virtual school. Now, as parents return to the office full time, day care and other expenses are soaring.

There are no restrictions on how families use the money. Parents report using it for day care, healthier foods, or kids’ enrichment programs, like swimming lessons and art classes.

According to Columbia University poverty data, North Carolina could see an estimated 49.4% reduction in child poverty if the American Family Act passes with a permanent CTC expansion. This supports our mission of each North Carolina child having a stronger foundation for lifelong health, education, and well-being.